Customers like a frictionless experience when it comes to finance. When a client has decided to transfer their assets, it’s important to educate them as much as possible. This means keeping customers in the loop as to where their assets are and when they are...

If CITs Have The Highest Growth Opportunity Then Why Aren’t We Investing In Tech?

July 18, 2019

At the recent Coalition of Collective Investment Trusts annual meeting in New York, a central topic of all the sessions was a clear move down market. CITs are no longer only marketed to and sold to the mega plans where they got their start 15...

More Tech Spend Equals More Profit…Right?

May 3, 2019

A recent article in Ignites caught my eye. It detailed a recent research report by Deloitte’s Casey Quick, which revealed that asset managers that spent the most on technology (related to distribution) over the last three years saw significantly higher profit margins than those of their peers.Continue...

DELTA DATA TO ATTEND AND EXHIBIT AT ICI GENERAL MEMBERSHIP MEETING

April 29, 2019

We’re looking forward to attending and exhibiting at ICI’s General Membership Meeting (GMM) in Washington DC May 1-3, 2019! In its 61st year, ICI’s GMM is a great opportunity to connect with other leaders in the global fund industry, as well as hear insights from their...

HOW TO STAY AHEAD OF THE CHANGE: TAKEAWAYS FROM NICSA STRATEGIC LEADERSHIP FORUM 2019

April 25, 2019

We recently returned from sunny Florida, where Delta Data sponsored, exhibited, and spoke at NICSA’s 2019 Strategic Leadership Forum, and we thoroughly enjoyed the event. From disruptive technologies to gender diversity in asset management, to fraud prevention, there were many engaging topics discussed at the...

DELTA DATA TO SPEAK AT NICSA’S 2019 STRATEGIC LEADERSHIP FORUM

March 26, 2019

We’re excited to announce that we will be exhibiting at NICSA’s Strategic Leadership Forum (SLF) in Ponte Verde Beach, FL April 3-5, 2019. As the must-attend event for professionals in the global asset management industry, NICSA SLF will be a great opportunity to connect with peers...

MUTUAL FUND SHARE CLASS CHURN SHOWS NO SIGNS OF SLOWING DOWN IN 2019

March 14, 2019

Product rationalization has been at the forefront of the mutual fund industry over the last few years. As a result, share class “churn,” which ramped up starting in 2016, is on pace to continue as managers add and replace share classes that better fit the...

MOVING TOWARDS A MODEL-DRIVEN WORLD: FUND ROUNDTABLE RECAP

March 6, 2019

Recently we had the opportunity to gather with asset managers and others in mutual fund operations in Boston for our annual roundtable, where we discussed many of the pressing issues changing our industry. We realize how difficult it can be to take a step back...

Automation is Key in Getting Fee Management Right

January 25, 2019

Intermediary fees make up a significant amount of a mutual fund company’s annual expenses, with some totaling as high as 40%. Maintaining such a major part of a Profit & Loss Statement isn’t something firms take lightly, so as the complexity and volume of the...

Unlocking Value of Mutual Fund Intermediary Transparency in 2019

January 15, 2019

Chief Compliance Officers (CCOs) certainly had a lot on their plates in 2018 – from MiFID II and GDPR to considerations around the DOL Fiduciary Rule and Liquidity Rule, there have been many pieces of regulation that have captured their attention and pushed them to...

New Year: Improve Your Counterparty Relationships

December 28, 2018

As 2018 comes to a close, it’s time to think about strategies to make 2019 your best year yet. Solutions that just “got the job done” in the past year do not cut it anymore as firms and industry professionals are looking to innovate and...

Why Unplanned Market Closures Put a Strain on Distributor Operations

December 11, 2018

Unexpected market closures, like the one we experienced recently for the funeral of former President George H. W. Bush, put the mutual fund industry in a precarious position. And while they don’t occur very often, when they do — it puts operations teams under serious...

Employee Spotlight: Bret Bange and Jason Davenport

November 19, 2018

Our employee spotlight this week, includes two great men. This year has been one of innovation, achievement, and exciting growth here at Delta Data. Some of our notable accomplishments in 2018 include the launch of new products such as FundBlast and our Proprietary Product Manager, recognition as a...

Financial Industry Trends: Reflections from our 2018 Client Conference

November 2, 2018

Every year, we have the privilege of bringing our clients together to talk about industry trends and discuss our latest product updates. It’s hands down the most instructive three days for us at Delta Data. They help us draw our innovation roadmap and keep our...

15 Years Since Market Timing Scandal

October 15, 2018

2018 marks the 15th year since the mutual fund industry was rocked by the worst scandal in its history: the market timing scandal. It was in September of 2003 when New York Attorney General Eliot Spitzer filed a complaint against the hedge fund Canary Capital...

Mutual Fund Sub-Advisor Oversight Requires a Data-Centric Approach

October 5, 2018

The relationship between a mutual fund company and its mutual fund sub-advisor is an important one. These trusted partners are relied upon for their expertise in managing strategies and products critical to the success of a fund company. The advantages of subadvisor relationships are well...

FundBlast Recognized by NICSA

September 11, 2018

Every year at NICSA’s General Membership Meeting, the top initiatives, technologies, and personalities in the asset management industry are presented with NICSA NOVA Awards. This year, we’re proud to announce that FundBlast won its “Innovation in Technology” Award, and are honored to have received this prestigious...

President Signs Executive Order on Strengthening Retirement Security

September 5, 2018

On August 31, 2018, President Trump signed an Executive Order on Strengthening Retirement Security in America. This EO directs the US Department of Labor and the Treasury to consider issuing regulations and guidance that would (1) make it easier for businesses to offer association retirement...

Working Through Liquidity Rule Bucketing Methods

August 30, 2018

As a firm dedicated to helping funds and distributors “stay ahead of the change,” we’ve been following the liquidity rule closely over the past year. Starting in the late fall of last year when ICI sent a letter to the SEC urging the regulator to delay the...

Counterparty Communications Seen as Most Neglected Function

July 31, 2018

Twenty years ago, email was coming into its own as a simple and effective solution for counterparty communications important information to large groups of people – a significant technological upgrade to faxes. For the fund industry, this has long been the standard for disseminating important...

DLT and AI Top of Mind at SIFMA Fintech Conference

June 28, 2018

Last week, I attended SIFMA’s Fintech conference in New York. I sat through panels discussing the topics of the day in financial services operations – emerging technologies, the ever-evolving regulatory landscape, you name it. Overall, it was an engaging event with interesting insights into how fintech is...

Fund Communication Shouldn’t Bog Down Broker Dealers

April 30, 2018

It’s indisputable that fintech is rapidly changing the landscape of financial services. It seems as though there’s a new innovation every day promising that Mutual Fund asset managers can leave their outdated legacy systems behind. Broker-dealers have been particularly hampered in recent years due to...

Disrupt, Don’t Disturb: What We Learned at the Mutual Fund Roundtable

April 18, 2018

We recently had the privilege to host some of our clients and Mutual Fund industry leaders for a roundtable discussion in Boston. It was an opportunity for us collectively to step away from our daily workplace rituals and talk about the future of our industry....

Liquidity Rule Delayed Six Months

February 26, 2018

The SEC voted on Wednesday to delay the compliance date of the classification requirement of the Liquidity Rule in what turned out to be a whirlwind of a week for the regulatory body. With a delay now formalized, fund firms with more than $1 billion...

3 Reasons Why You Should Take a Sales Meeting

November 28, 2017

For some people, taking a sales meeting is on par with going to the dentist — they’ll avoid it at all costs. Avoiding the dentist due to an unreasonable fear will eventually come back to haunt you, just like skipping an informative sales call could mean...

The Best Plan for a Potential Liquidity Rule Delay? Plan for No Delay

November 21, 2017

There have been multiple developments suggesting that Rule 22e-4 (“the liquidity rule”) is likely to be significantly watered down or, at least, delayed. Earlier this month, ICI sent a letter to the SEC urging the regulator to delay the compliance date by a year to ensure firms...

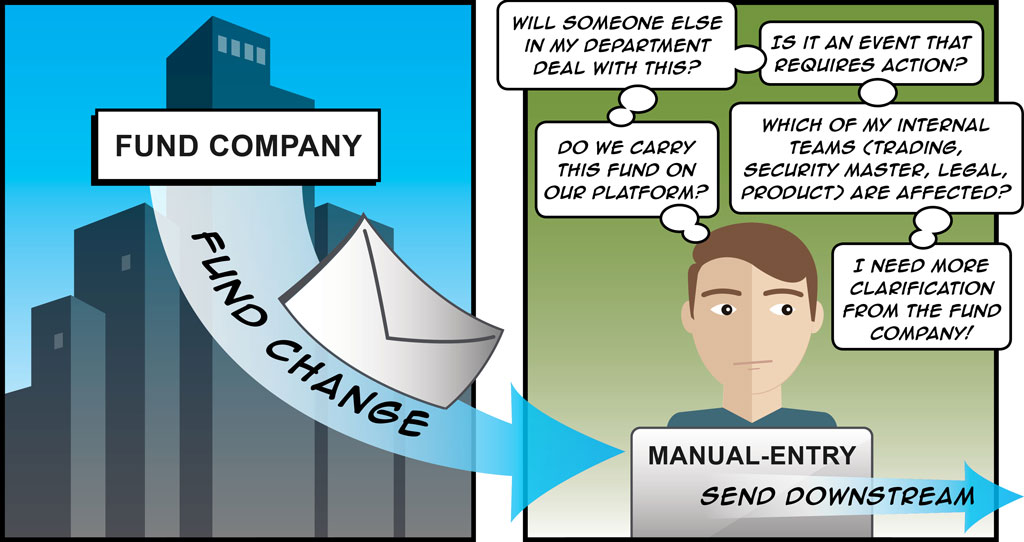

Peeking Behind the Curtain of Mutual Fund Corporate Actions – Part II

November 9, 2017

As we highlighted in our last post, corporate actions play a crucial role in the day-to-day management of mutual funds as well as the Broker-Dealers, Bank Trusts and Record Keepers that distribute them. Once the corporate action blast email is sent out and received by distributors, a multi-step process,...

The GOP’s Tax Reform: Retirement Plans Safe (for Now)

November 3, 2017

The House finally released a draft of their tax reform plan, and for right now, it looks like they will be leaving 401(k) contributions alone. Back in April, I wrote about how the Trump administration was looking at changing the deductibility of 401(k) deferrals as a way to...

3 Takeaways from NICSA’s 2017 General Membership Meeting

October 23, 2017

Delta Data recently attended NICSA’s 2017 General Membership Meeting in Boston to gain a deeper understanding of what’s driving innovation in the financial services industry. The day passed quickly with keynotes, panel discussions, and roundtables with industry experts, and we gleaned some interesting insights into what the...

How to Achieve Successful Technology Vendor Partnerships in the Mutual Fund Industry

October 12, 2017

The relationship between mutual fund companies and technology vendors has changed dramatically in the last decade. Fund shops over this time have collectively decided that the amount of due diligence and associated costs of working with dozens of vendors was too burdensome, and frankly not...