At the recent Coalition of Collective Investment Trusts annual meeting in New York, a central topic of all the sessions was a clear move down market. CITs are no longer only marketed to and sold to the mega plans where they got their start 15 years ago. Smaller 401k plans are now the target and this shift in demographics could spell disaster without technology support.

Why this shift is expediting:

- Increased awareness of the capabilities, ease of access, and cost are encouraging advisors and consultants focused on the medium and small plan market to use the products. Distribution of materials that educate advisors who are focused on the small plan market tailored to them to identify the availability of low AUM criteria CITs applicable to the micro-plan market is a significant driver of growth.

- Support of CITs by the DTCC’s FundServ and Profile I in concert with bespoke solutions and data services from providers like Delta Data make transactions more efficient and instill an expectation on daily pricing and accurate and efficient trade execution.

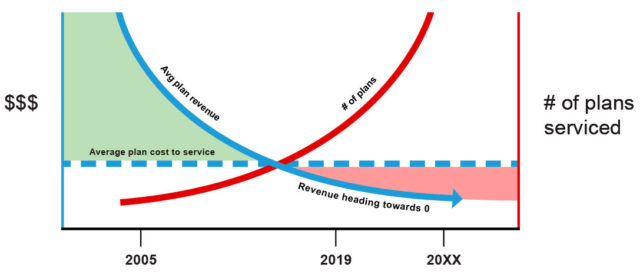

The education of advisors and consultants that service the down-market plans feels like it has reached a critical marketing mass. This will lead to the increased volume of smaller plans it was designed to promote. The question that remains is whether the providers will remain profitable given their current manual configuration. Manual business processes scale poorly, while the revenue per plan decreases given their smaller AUM.

Business Background:

Early Stage: 2005

Average mega plan that leveraged a CIT which had $3B in AUM with approximately 1/3 the assets in the QDIA CIT and paid approximately 20BPS for a CIT.

- Cost: This plan represented one set of paperwork for setup and annual manual confirmation of the sponsor of eligibility. Assorted other transparency files were put together and shared between the consultant, record keeper, asset manager, and bank trust.

- The business supporting the product line could yield north of 6bps in margin = (6bps*$1B = $600k / year).

Late Stage: 2019

The industry is actively marketing Zero AUM entry point CITs now, so let’s say “XYZ Corp” with $3M in assets invests in the same CIT with similar participation and pays roughly the same in cost, given 15 years of fee compression offset by a premium for the small plan assets.

- This plan constitutes the same amount of paperwork as the mega plan for legal and compliance reasons as well as to gather data which is used to deliver the product but yields the same 6bps in margin = (6bps*$1M= $600/year).

Very little technology has been brought to bear in the face of this staggering perfect storm of reduced revenue per plan and the exploding number of plans using the products. Without technology to scale this delivery using true straight-through processing, the margins of this business will collapse. The only out is to reduce the cost to service per plan. We cannot increase the cost of the CIT because that is the golden egg which is driving the growth.

As ANY industry heads down-market with something originally designed as a bespoke item for the largest players, they will need the technical support to make the down-market move cost-effective. In the CIT industry the following areas will need technical focus to enable sales to the bottom of the plan market at scale and with a decent margin:

- Automation:

- Remove the manual setup of new products whereby coordination across the trust, record keeper, sponsor (consultant), and asset manager takes minutes, not weeks.

- Automate the addition of the next plan’s investments into existing products and update of associated paperwork amongst interested parties to the agreements.

- Annual attestations from sponsors of eligibility of the plan for the investment.

- Distribution of NAVs among interested counterparties should be aligned with the timing when it is needed, and not how it is most easily delivered via mutual fund conduits at less than optimal and rigid time frames designed to support 40 ACT processes.

- Communication of changes to allocation models and updates to underlying assets in the lineups and the confirmation of those actions effected within the security.

- Standardization:

- Allocation models, security identification, and reference data need to have better similarity — if not outright standardization — that allow for service providers to plan long term STP roadmaps around.

- Access to transparency information exists but is usually a manually created and emailed spreadsheet. An industry standard for reporting CIT assets, plan information, and associated supporting information will allow for scalable compliance and greater confidence in billing and payments.

Delta Data work, along with other technology service providers, addressing these technical needs will result in directional improvements in both automation and standardization. The Coalition of Collective Investment Trusts is educating service providers on necessary support as well as evangelizing the technical capabilities as they come available. This will help coordinate change in the direction needed to maintain margin and increase product delivery capabilities.

Join our conversation. Subscribe to our blog or contact us for more information about Delta Data’s solutions for CITs.