Solutions for Asset Managers & Transfer Agents

Gain more visibility into what your distribution partners are doing

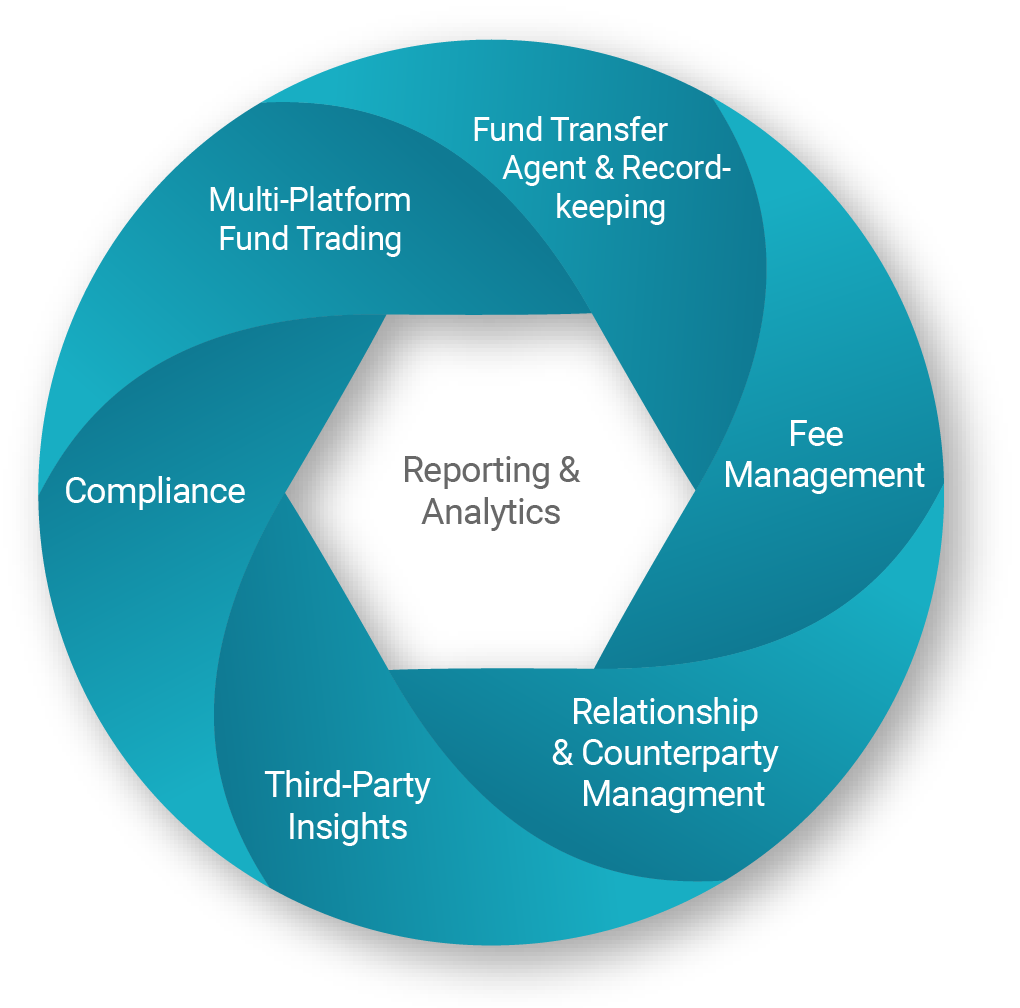

Delta Data Asset Management Solutions leverage distribution transparency data with integrated reporting and analytics to simplify the relationship between asset managers and fund distributors.

Our Solutions

How We Simplify Your Intermediary Oversight

Fee Management

Exception-based workflow tool for managing and approving intermediary fee payments with integrated reporting and analytics. Straight-through processing with configurable tolerances streamlines invoice validation.

Relationship & Counterparty Management

Centralized portal supports the workflow for all intermediary interactions. Provides the ability to evaluate intermediary relationships quantitatively and qualitatively for better management and reporting of oversight activities.

Third-Party INSIGHT powered by NQR

National Quality Review (NQR), a Delta Data Company, provides leading US financial institutions with unbiased insights into third-party shareholder servicing, distribution, custody, and other major operations.

Compliance

Automated monitoring and analytics for complete 22c-2, sub-account, and omnibus fund policy trade monitoring, ensuring adherence to market timing policies and prospectus rules.

Fund Transfer Agent & Recordkeeping

Flexible, cross-border transfer agent and shareholder recordkeeping system for processing all pooled assets, including mutual funds, hedge funds, collective funds, UIT’s, and closed-end funds.

Multi-Platform Fund Trading

Streamline the entire fund trading processes seamlessly across global markets by leveraging industry-standard messaging protocols like NSCC Fund/SERV, Canadian FUNDSERV, and more.

Why Asset Managers Choose Delta Data

Delivering all the functionality asset managers need to…

- Manage Fees More Efficiently

- Monitor Compliance More Effectively

- Maintain & Monitor Intermediary Relationships

Who We Serve

MUTUAL FUND COMPANIES

TRANSFER AGENCIES

FUND SERVICING COMPANIES

Resources for Asset Managers

White Paper

Streamline your intermediary invoice validation and payments, reduces risks, and free up resources to work on more strategic objectives.

White Paper

Article

The ultimate goal is to gain a clear and comprehensive risk picture for each entity distributing the asset manager’s funds.