Every year, we have the privilege of bringing our clients together to talk about industry trends and discuss our latest product updates. It’s hands down the most instructive three days for us at Delta Data. They help us draw our innovation roadmap and keep our efforts focused on solving their problems rather than chasing the buzzwords in the headlines. I may be the CEO of Delta Data, but I’m proud to say that our clients truly guide the direction of our company. And I wouldn’t have it any other way.

Our mission remains the same: to help our clients stay ahead of the change, no matter what that change may be. This means regularly evaluating how we leverage our people, our expertise, and our clients’ trust to produce great products that make our clients’ jobs easier.

Here are a few things I thought were notable as I had a few days to reflect on those three days in Atlanta with our clients.

If you don’t ride the wave of change, it will wash over you

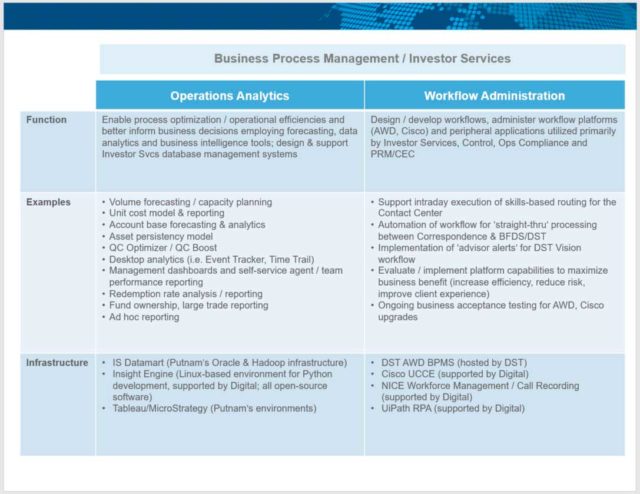

We were honored to have Michael Woodall, Chief of Operations at Putnam Investments, provide our keynote address. As he brought us through Putnam’s journey over the years, Michael touched on many topics. What stood out to me was that as Putnam’s business evolved going into and coming out of the financial crisis, so did its relationship with data. In many ways, it was a microcosm for the financial services industry at large. Digitization gave way to data becoming more accessible, which led to the advent of modern analytics. Firms are more strategic about their data today than ever, and as computing power improves, we are being ushered into an era where extracting business-changing insights from machine learning feels imminent.

It’s an exciting time for sure, but that doesn’t mean it isn’t also daunting. Michael summed it up with a simple observation, if not a plea to the audience to embrace the change as it comes.

“If you don’t ride the wave of change, it will wash over you.”

I agree with him and would take it a step further. Whether or not you ride the wave or let it take you under, we’re all getting to shore at some point. Major innovations normally run their course through an industry eventually. How you approach the wave will determine what shape you’re in when you wash up on the beach.

FundBlast is picking up momentum

As you know, we launched FundBlast earlier this year and are now off to the races signing on fund and distributor clients. We’ve been fortunate to have strong industry support from firms like BNY Mellon, who gave a FundBlast walkthrough during the conference. It was such a validating experience having a live client share how FundBlast has made a positive impact on their business, and our hope is that our other clients in the room benefitted from hearing BNY’s perspective as an industry peer.

If you missed it, NICSA recently recognized FundBlast with their “Innovation in Technology” award at their general membership meeting in Boston in October. In addition to our clients’ feedback, being recognized by an industry-leading association such as NICSA serves as additional validation that the work we’re doing matters.

As momentum continues to build, we’re more dedicated than ever to becoming an industry standard that strengthens the relationships between funds, broker-dealers, and other intermediaries.

AI is on the way, but RPA is at the door

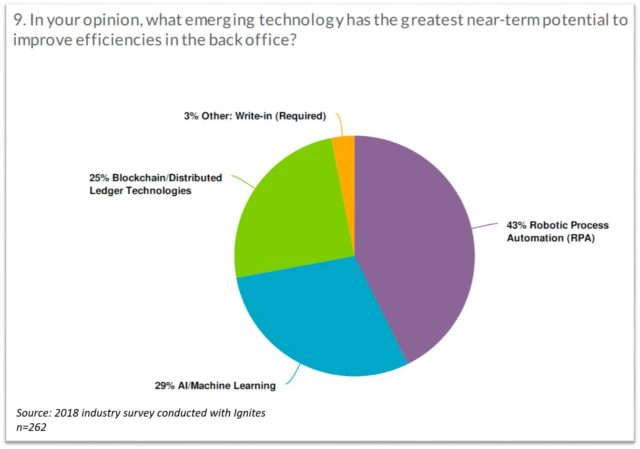

We ultimately believe in the future of AI but are careful not to overlook the “now” of Robotic Process Automation (RPA). A simple form of RPA has been around for years, but as we move into the next evolution of rules-based automation, the untapped potential and efficiencies to be gained in operations are significant. This is reinforced by some of the research we conducted earlier this year with Ignites looking at technology trends affecting operations.

During one particularly lively discussion around RPA in practice, change management seemed to emerge as one of the final hurdles facing the technology. How do you let your army of bots know something has changed without disrupting the whole system? If one bot comes across an anomaly, what are the best monitoring procedures to ensure errors are corrected in a timely manner? These issues haven’t slowed down RPA and we don’t see that changing anytime soon.

We have some exciting projects in the works leveraging RPA and AI that we believe will make our solutions more efficient than ever. That’s all I can say for now – stay tuned for more updates in 2019.

If you weren’t able to attend our client conference and are interested in what was discussed, please don’t hesitate to reach out to us. We hope to see you at the next one!