Every year at NICSA’s General Membership Meeting, the top initiatives, technologies, and personalities in the asset management industry are presented with NICSA NOVA Awards. This year, we’re proud to announce that FundBlast won its “Innovation in Technology” Award, and are honored to have received this prestigious...

President Signs Executive Order on Strengthening Retirement Security

September 5, 2018

On August 31, 2018, President Trump signed an Executive Order on Strengthening Retirement Security in America. This EO directs the US Department of Labor and the Treasury to consider issuing regulations and guidance that would (1) make it easier for businesses to offer association retirement...

Working Through Liquidity Rule Bucketing Methods

August 30, 2018

As a firm dedicated to helping funds and distributors “stay ahead of the change,” we’ve been following the liquidity rule closely over the past year. Starting in the late fall of last year when ICI sent a letter to the SEC urging the regulator to delay the...

Counterparty Communications Seen as Most Neglected Function

July 31, 2018

Twenty years ago, email was coming into its own as a simple and effective solution for counterparty communications important information to large groups of people – a significant technological upgrade to faxes. For the fund industry, this has long been the standard for disseminating important...

DLT and AI Top of Mind at SIFMA Fintech Conference

June 28, 2018

Last week, I attended SIFMA’s Fintech conference in New York. I sat through panels discussing the topics of the day in financial services operations – emerging technologies, the ever-evolving regulatory landscape, you name it. Overall, it was an engaging event with interesting insights into how fintech is...

Fund Communication Shouldn’t Bog Down Broker Dealers

April 30, 2018

It’s indisputable that fintech is rapidly changing the landscape of financial services. It seems as though there’s a new innovation every day promising that Mutual Fund asset managers can leave their outdated legacy systems behind. Broker-dealers have been particularly hampered in recent years due to...

Disrupt, Don’t Disturb: What We Learned at the Mutual Fund Roundtable

April 18, 2018

We recently had the privilege to host some of our clients and Mutual Fund industry leaders for a roundtable discussion in Boston. It was an opportunity for us collectively to step away from our daily workplace rituals and talk about the future of our industry....

Liquidity Rule Delayed Six Months

February 26, 2018

The SEC voted on Wednesday to delay the compliance date of the classification requirement of the Liquidity Rule in what turned out to be a whirlwind of a week for the regulatory body. With a delay now formalized, fund firms with more than $1 billion...

3 Reasons Why You Should Take a Sales Meeting

November 28, 2017

For some people, taking a sales meeting is on par with going to the dentist — they’ll avoid it at all costs. Avoiding the dentist due to an unreasonable fear will eventually come back to haunt you, just like skipping an informative sales call could mean...

The Best Plan for a Potential Liquidity Rule Delay? Plan for No Delay

November 21, 2017

There have been multiple developments suggesting that Rule 22e-4 (“the liquidity rule”) is likely to be significantly watered down or, at least, delayed. Earlier this month, ICI sent a letter to the SEC urging the regulator to delay the compliance date by a year to ensure firms...

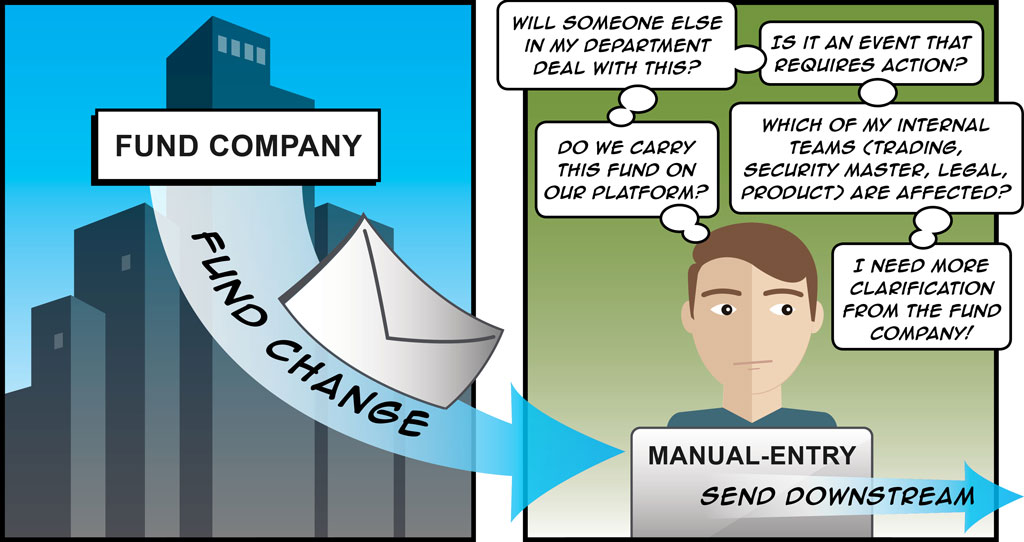

Peeking Behind the Curtain of Mutual Fund Corporate Actions – Part II

November 9, 2017

As we highlighted in our last post, corporate actions play a crucial role in the day-to-day management of mutual funds as well as the Broker-Dealers, Bank Trusts and Record Keepers that distribute them. Once the corporate action blast email is sent out and received by distributors, a multi-step process,...

The GOP’s Tax Reform: Retirement Plans Safe (for Now)

November 3, 2017

The House finally released a draft of their tax reform plan, and for right now, it looks like they will be leaving 401(k) contributions alone. Back in April, I wrote about how the Trump administration was looking at changing the deductibility of 401(k) deferrals as a way to...

3 Takeaways from NICSA’s 2017 General Membership Meeting

October 23, 2017

Delta Data recently attended NICSA’s 2017 General Membership Meeting in Boston to gain a deeper understanding of what’s driving innovation in the financial services industry. The day passed quickly with keynotes, panel discussions, and roundtables with industry experts, and we gleaned some interesting insights into what the...

How to Achieve Successful Technology Vendor Partnerships in the Mutual Fund Industry

October 12, 2017

The relationship between mutual fund companies and technology vendors has changed dramatically in the last decade. Fund shops over this time have collectively decided that the amount of due diligence and associated costs of working with dozens of vendors was too burdensome, and frankly not...

Throwback Thursday – Tax Reform and Taxing 401K Plan Contributions

August 31, 2017

Last April I wrote a piece on what a bad idea I thought it was to Rothify 401K plans (see “Trump Administration Looking at Changing the 401K Tax Rules“). As you probably know already, participant 401k contributions are taken out of your pay before federal...

Peeking Behind the Curtain of Mutual Fund Corporate Actions

August 23, 2017

The accurate and timely tracking of corporate actions is an integral component in the day-to-day management of mutual funds and the Broker Dealers, Bank Trusts and Record Keepers that distribute them. (We’ll refer to this group as “Distributors” or “Dealers” in this blog post.) Today...

4 Reasons ACATS Fails with Mutual Funds in Trust Companies and How To Fix It

May 17, 2017

Automated Customer Account Transfer Service (ACATS) burst onto the scene in the early 2000s and revolutionized the ability for investors to move entire portfolios between financial institutions. The technical capability and usage far exceeded the expectations set forth, and it has reached ubiquity within Capital...

Trump Administration Looking at Changing the 401(k) Tax Rules — Very Bad Idea

April 19, 2017

The Trump administration has been clear in stating its objective to reduce individual and corporate tax rates. But to fund the reduction in tax revenue, one of the items they are looking at changing is the deductibility of employee 401(k) deferrals. The Joint Committee on...

Will You Be Ready If FINRA Calls? Brokers Are Running Out of Time for Mutual Fund Fee Waiver Remediation

April 3, 2017

The Problem Investment companies have long allowed some retirement plans to buy Class A mutual fund shares with no up-front commission, so investors can benefit from investing with no commission as well as benefiting from lower management fees. But during routine audits in 2014, the...

FSOC’s Future Under the New Administration

March 27, 2017

Almost a year ago I posted a blog entitled SEC, Dodd Frank, Money Market Reform and FSOC: Connecting the Dots Between the Acronyms. In the post, I expressed my dismay with the passing of the Money Market Reform (MMR) laws, and how it seemed to me...

In Episode 12 of the Days of our DOL Lives …

February 9, 2017

Congress still on the “outs” with DOL pick ─ who, in turn, has undisclosed Nanny Baggage to resolve. Meanwhile, Donald still has commitment issues … If you thought this was going to be a political piece, sorry to dismay but it is not. This is...

For Mutual Fund Distributors, RegTech Is Now A Question of Survival

January 20, 2017

Whatever happens to the Department of Labor fiduciary rule, the mutual fund industry is moving into a “fiduciary era.” For one thing, investment advisors hope to capitalize on investors’ heightened awareness of the role of a fiduciary. For another, the backlog of regulatory change that...

SEC Guidance Paper is a Heads Up for Potential Avalanche of Filings

January 5, 2017

In light of the upcoming DOL Rule, the SEC recently issued guidance to funds on disclosure issues and certain procedural requirements with offering variations in fund sales loads and new share classes. The SEC IM Guidance Update appears to be an attempt by the SEC to not...

The DOL Fiduciary Rule is Igniting a Revolution in the Mutual Fund Industry’s Back-Office

December 19, 2016

The burning issue for the mutual fund industry is whether the Trump administration will curtail or rescind the Department of Labor’s fiduciary rule. The nomination of Andrew Puzder for Labor Secretary, who is anti-regulation, could mean changes to the fiduciary rule as it currently stands....

Jim Carrey for Education Secretary and Effect on DOL Rule

December 8, 2016

Today’s news declaring Andy Puzder as Trump’s pick for Labor Secretary does not bode well for the short-term prospect of moving the date of the DOL Fiduciary Rule. For the past several weeks, the consensus in our industry was that the date could be moved by the...

The New Stripped Down Mutual Fund Share Classes

November 8, 2016

The new DOL Fiduciary rule has barely gone into effect, and it is already starting to shake things up. One of the first changes we are starting to see is a new set of mutual fund share classes. American Funds and Franklin Templeton have already...

Mutual Funds, Bank Trusts and Money Market Reform

November 2, 2016

The Money Market reforms promulgated by the SEC became effective October 14, 2016. The implications of the reforms go deep and wide, both with the mutual funds that offer money market funds, but also for the firms that offer money market funds on their platforms....

Help with Business Continuity Planning for Asset Managers

October 7, 2016

Ignites recently published an article “Shops Zero In on Fund Pricing Risk Management” about a Deloitte survey that examined what Fund shops are spending time on — keeping their folks up at night. A breakout star this year is business continuity planning (BCP) of their key third party...

Mutual Fund Transparency in Support of DOL Rules

September 30, 2016

The last several years have demonstrated an ongoing focus on transparency driven by guidance and rules from the governing bodies of the mutual fund industry. To date, most transparency initiatives have focused on Dealer to consumer transparency (404a and 408b2) and Dealer to Fund transparency...

Mutual Funds Omnibus Transparency – Lighting up the Black Cat in the Dark Room

September 21, 2016

The phrase, “knowledge is power,” takes on a special meaning when a paucity of knowledge leads to potential issues that leave a company fumbling around in a dark room, looking for a black cat, only to be saved when someone turns the lights back on....