As we highlighted in our last post, corporate actions play a crucial role in the day-to-day management of mutual funds as well as the Broker-Dealers, Bank Trusts and Record Keepers that distribute them.

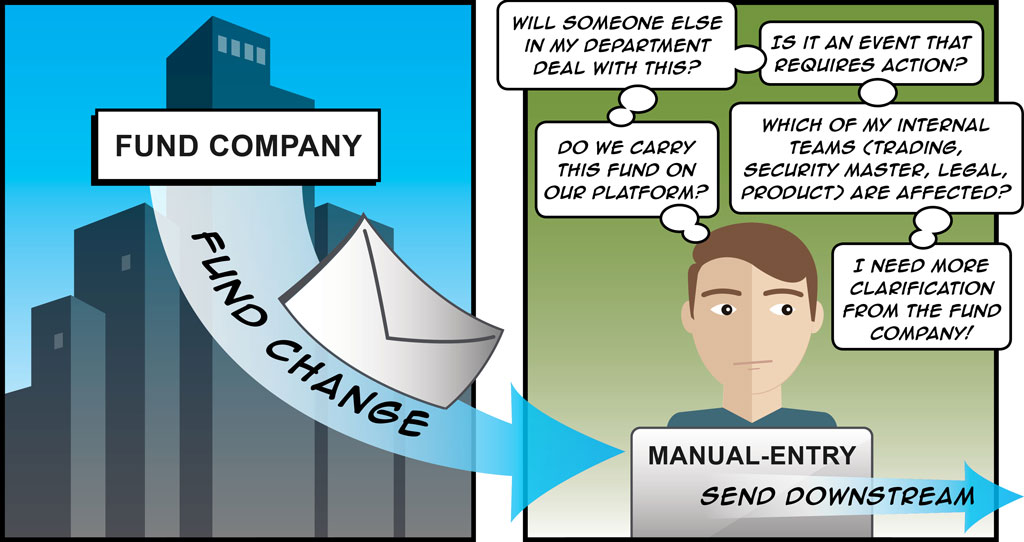

Once the corporate action blast email is sent out and received by distributors, a multi-step process, chock full of obstacles and risk begins. Deciphering what’s being communicated and if/how it effects your enterprise is rarely a simple task. We’ve listened to our distribution clients — and here’s what we’re hearing about the current state of corporate action blast communications.

The Email Blast

Today’s distribution of mutual fund corporate actions is completely email-based. This might seem to be convenient allowing the asset managers to communicate information to many firms and recipients at once. However, this ultimately makes more work for the people on the receiving end of the email chain and doesn’t guarantee that the fund companies are sharing relevant information with the indented audience. Here’s why.

To begin the distribution process, the fund companies send out a blast email to a large distribution list of users. Who knows when this list was updated? The messages are usually from a “do not reply” address making it unclear who at the fund originated the email. Simply replying to the sender with a basic question is not an option.

It’s not obvious to the fund company whether they’ve reached their intended recipients. When funds send out an email blast detailing a change, it gets sent to the entire industry and distribution list. Since distributors don’t carry every fund company’s products on their platform, that the email may not be relevant. Further, the intended recipient might no longer be with the firm. For distributors, this introduces wasted time reading unnecessary emails and the risk of a missed notification and critical information. I hear of both these scenarios all the time.

Interpreting the Email

Now that the distributors have received redundant copies of the email, which might not even be relevant to that firm, the recipients are tasked to read and interpret them to identify any/all pertinent information. Over 600 firms originate these types of emails, each with their own way of presenting the message. Interpreting takes much longer than it should. The information could be in the form of a Microsoft Excel spreadsheet, PDF attachment or embedded in the body of the email. Additionally, free text-based messages can be muddled and difficult to ascertain critical information. Introducing human error…

One of our clients estimated they received approximately 14,000 corporate action blast emails January through August of this year. What’s more staggering is they replied about 7,200 times back to the fund seeking clarification or additional details to the message. That’s a lot of time wasted.

Once the distributor reviewed the blast email for content, they must identify if there’s action required by them or not. An example of a no-action email would be if the information was to simply inform the distributors of a management change in the fund. If the distributor interprets the email to be an action email (i.e. if it were about a fee breakpoint), they would then have to, as the name suggests, take action upon the notification. Both are critically important.

Sending the Information to Affected Parties

At this point in the process, the distributors have to manually input all relevant information into their firm’s enterprise system. They are again exposed to risk and error. After the data is entered into the system, the recipient compiles the notification into actionable items. Alerts are communicated downstream to various departments and parties affected by the news. This can include sales, legal, compliance, and operations.

The representatives from sales, legal, compliance, and operations then have to communicate the event to their teams who turn around and distribute the information downstream to qualified customers. While many firms have their own process and checklist ensuring that they’re prepared and properly handle corporate actions, how can they clearly identify that this process has run correctly and is complete?.

For example, if the fee breakpoint changes on a fund, sales would then have to communicate that change to their clients (advisors, asset managers, etc.) and operate under those conditions once the action is made effective.

Risks and Costs

While there have been many impressive technological advances in the mutual fund industry, there is still much to do. Processing mutual fund corporate actions is lagging far behind.

From the format of the message to the volume of emails to the manual means of moving information, the current method of communicating corporate actions leaves firms with a high level of operational and human risk. That doesn’t even account for the added risk of repeating the process if an action is changed or canceled after it’s initially communicated.

Firms on both sides of the corporate actions process waste a lot of time in this process. The old adage rings true, time is money. The FTE cost of inaccurate or incomplete data and wasted time sorting, dissecting, interpreting and communicating email content is one that should not be underestimated.

The mutual fund corporate actions process is archaic, convoluted and begs for a digital enhancement. The ideal solution will facilitate direct communication across all parties throughout the process, allowing for greater operational efficiency and transparency in real time.

Delta Data’s transformative corporate actions solution is now live, eliminating all the above headaches.

Would you like more information on how to improve your corporate actions management? Contact us today to learn more.