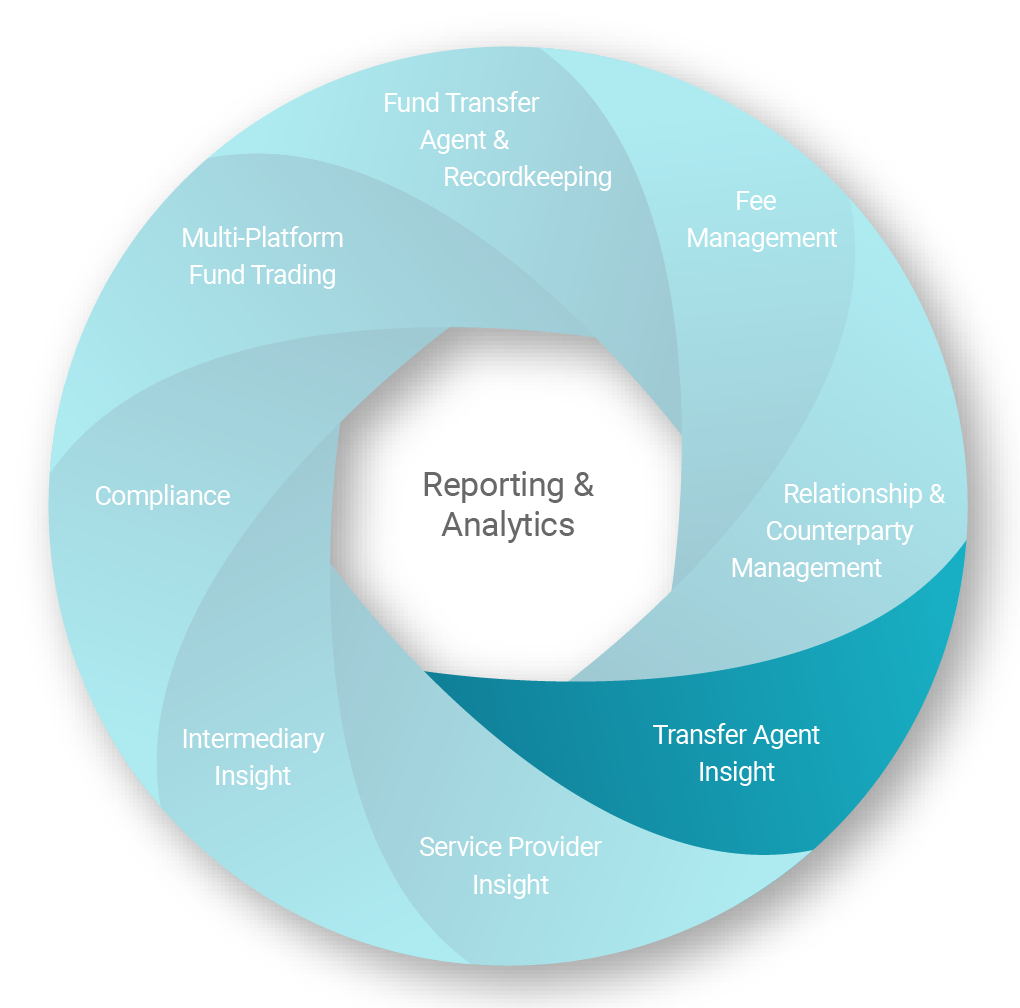

ASSET MANAGER & TRANSFER AGENT SOLUTIONS

Elevate Transfer Agent Services to Surpass Shareholder Expectations

Delta Data’s Transfer Agent Insight provides financial services firms with unbiased, in-depth evaluations and service benchmarks to help them navigate the changing customer experience landscape. With actionable feedback, firms can pinpoint strengths and areas for improvement in processing, call center, and correspondence operations, seamlessly implementing targeted process enhancements that ensure shareholder service excellence.

WHAT SETS US APART

Why Businesses Choose Delta Data for Transfer Agent Insight

Service Quality

- Leverage Delta Data’s expertise to identify service gaps and process improvement initiatives

- Improve client retention and shareholder perceptions of your brand

- Build your legacy by achieving Delta Data Benchmarking Awards, where top performers in the benchmark comparisons are recognized

Efficiency

- Reduce operating costs by providing first-call resolution and first-time quality

- Pinpoint operational and regulatory blind spots to mitigate risk swiftly

- Spend less time retrieving feedback and more time crafting action plans

Transparency

- Get a holistic perspective on your customer service performance compared to industry peers

- Gain competitive intelligence on industry priorities through Delta Data clients navigating the same service quality challenges

- Supplement analyses with feedback gathered directly from customers

OUR APPROACH

Committed to Your Success

Our commitment to your success is at the core of our approach. A dedicated client success manager will work with you on an ongoing basis to ensure that Delta Data’s reporting and client benchmarking consistently provide you with the insights needed to drive optimal outcomes.

- Streamlined Transaction Processing

Delta Data collects a random transaction sampling from the transfer agent’s image processing system, then connects to TA processing and/or client systems to verify accuracy and compliance with regulatory requirements. This analysis reveals both quality strengths and opportunities for improvement.

key features

- Quality assessment of transaction processing accuracy and timeliness

- Criteria based on client prospectus rules, fund industry guidelines, and compliance with IRS and SEC regulations

- Guaranteed consistency through Delta Data’s proprietary “rules-based” software that stores and identifies requirements for thousands of load and no-load transactions

- Root cause analysis provides a snapshot of operational efficiency

- Superior Call Center Experience

Research suggests that poor service experiences often drive customers to competitors while the cost of customer service calls continues to rise. At Delta Data, we help you balance exceptional service and cost-efficiency. Our call center evaluation examines CSR performance and customer satisfaction metrics to reduce callbacks, liability, and talk time.

key features

- Statistically reliable quality analysis of randomly selected inbound calls

- Focus on compliance ensures callers receive accurate compliance information and associates adhere to security verification requirements

- Customer interaction analytics capture the Voice of the Customer and provide actionable feedback on ways to enhance customer experience

- Third-party expertise provides business intelligence, call center trends, call patterns, and best practices

- Comprehensive Shareholder Correspondence

Delta Data’s shareholder correspondence review focuses on accurate, complete, and specific information to handle even the most complicated exchanges. By assessing your correspondence, we help minimize the need for follow-up communications or costly call center interactions, ultimately lowering operating expenses.

key features

- Quality evaluation of letters and emails through industry-leading scoring mechanisms

- Feedback on processing time, content, clarity, grammar, and typographical accuracy

- Observations highlight opportunities to simplify processes to improve the customer experience