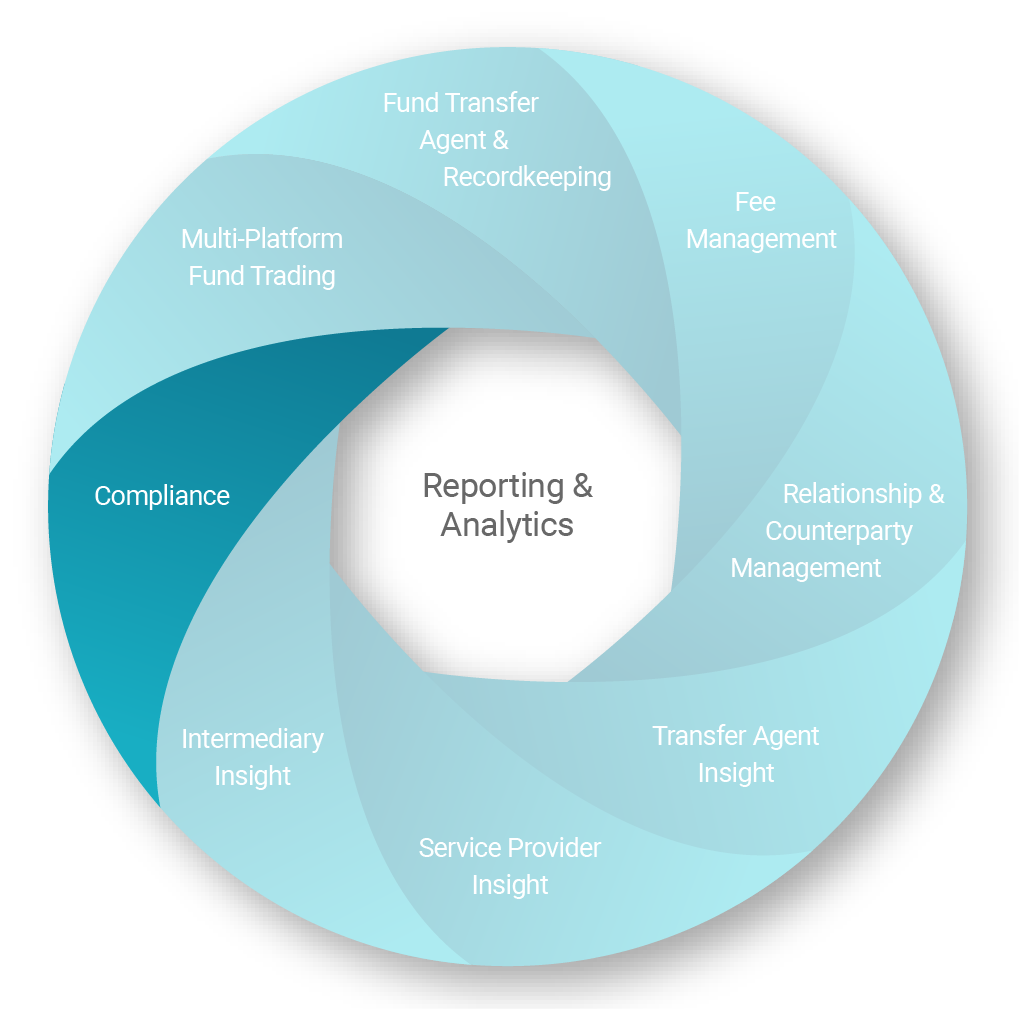

SOLUTIONS FOR ASSET MANAGERS

22c-2 compliance monitoring and reporting

Automated monitoring and analytics for complete 22c-2, subaccount, and omnibus fund policy trade monitoring

Delta Data’s monitoring and reporting solution provides the ability to manage requests sent by fund companies, analyze the data received, report on 22c-2 activity, and perform administrative functions to help meet the demands of SEC Rule 22c-2.

Why Businesses Choose Delta Data

Effectively Monitor 22c-2 Compliance

Transparency Data

- Access transparency data, both activity and positions, for other ad-hoc reporting and analysis

- Full data warehouse for storing TA and sub-TA transparency files

- Multi-system interface integrated to transmit and accept data from NSCC and accept data from Omni/SERV and SuRPAS

Intelligent Rule Functionality

- Filter out noise from false positives with intelligent rule functionality by only flagging transactions that require review

Flexibility

- Add traditional rules as compliance and regulatory requirements expand over time

- Customizable analytic rules and fully automated analytic processing across both omnibus and participant trades

Fully Automated Compliance

- Delivers trade activity transparency to asset managers, ensuring adherence to market timing regulations and prospectus rules

- Monitors for 22c-2 excessive trading, subaccount trade rule, Blue Sky, and omnibus large trade violations

Auto-Curated Data

- Analysis of auto-curated data is business rule-based in order to monitor for market timing events and other trade rule violations

- Violations are identified, shareholders are monitored on a watch list, and sanctions are applied to individuals with repeat offenses

Program Integration

- Serves as the primary data warehouse for Delta Data’s Asset Management Solutions suite

- Connects with Fee Management and Counterparty Oversight to power counterparty analytics in a single place

Sourced Data

- Data is sourced directly from NSCC, guaranteeing standardized and up-to-date trade data from the intermediary