Recently we had the opportunity to gather with asset managers and others in mutual fund operations in Boston for our annual roundtable, where we discussed many of the pressing issues changing our industry. We realize how difficult it can be to take a step back to evaluate how our industry is changing, so we’re grateful to have had the opportunity to hear from key companies and individuals to strategize on challenges and opportunities brought on by industry disruption.

Our agenda included in-depth discussions and debates, in addition to an insightful presentation from Avi Nachmany, founder of Strategic Insights and now an independent consultant to the industry, where he discussed the key forces shaping the US mutual fund industry.

Reflecting on the roundtable, it became clear that the times are changing, and changing faster than we’re used to.

Enter the CIT, which dominated the conversation throughout the day. CITs continue to gain popularity, and that’s a trend that’s likely to persist for the near future. As CITs continue to move downstream in retirement plans, and advisor demand increases in the fiduciary era, asset managers in the room talked about adding CITs to “beef up their buffet” of strategies. Operational complexity remains the CITs biggest obstacle to overcome, as set up and maintenance requires more manually intensive processes. However, firms see the benefits well outweighing the stress piled on the back office, so it was unanimously concluded that improving efficiencies will need to be a priority to properly support CITs, and soon.

In addition to operational complexity, the lack of regulation and standardization of CITs compared to traditional mutual funds had many clients discussing the Coalition of Collective Investment Trusts (CCIT) and the important role it is playing to shape the future of CITs. Although the CCIT has only been around since 2012, it’s apparent that this year will be its most influential yet.

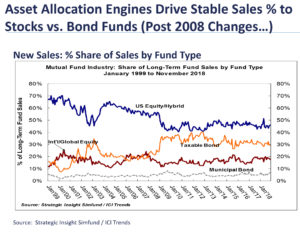

Reflecting on the discussion, it seems like CITs are less of a major trend impacting the way asset managers operate but are symbolic of a much bigger transformation underway. With end clients wanting greater simplicity, asset allocation models, developed by asset managers and sold to advisor platforms, are the future of investing. Once sold, the dealer can take the models that can be included in any custom investment vehicles, whether it’s a CIT, SMA, or any other type of other wrapped fund.

Smart asset managers are pivoting their business models to get ahead of this, but many can’t see the forest through the trees, using vast amounts of resources to churn out new strategies to satisfy dealer requests.

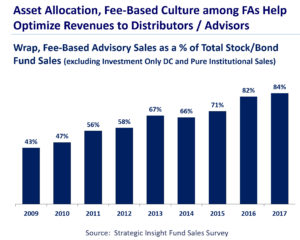

Some of Avi’s research underscored how quickly these changes are actually happening. For example, in 2017, 84% of total stock/bond fund sales came via a wrap, fee-based advisor (compared to just 43% in 2009).

Certain actively managed products will always have relevance, especially if they’re highly specialized or particularly well-performing. At the end of the day, performance still reigns supreme – it’s just becoming hard to stand apart by that measure. But the writing is on the wall. The truth is, we’re moving towards a model-driven world.

As the lines begin to blur between asset managers, broker dealers, custodians, and advisors, operations teams will have to make sure they’re able to keep up. As the backbone of these firms, they will bear the majority of the weight of these changes as they begin to take hold.

This is exactly why these types of client events continue to be important for Delta Data. Whether it’s rolling out our Proprietary Product Manager, or launching FundBlast, helping our clients stay ahead of the change and developing the tools and solutions they need begins and ends with maintaining strong feedback channels. Roundtables like this are essential for that maintenance.

If you missed our roundtable and would like to hear more about what was discussed, don’t hesitate to get in touch.